- Home

- Investing

- How we invest

- Strategy

Strategy

Setting a direction for the long term

Railpen is responsible for the strategic advice, implementation, and investment management of four pension schemes, for which the Trustee has fiduciary responsibility. The Railways Pension Scheme is the largest of the four and one of the largest pension schemes in the UK.

We manage around £34 billion in assets; over 95% of these are in defined benefit (DB) arrangements across nearly 150 clients – the different 'sections' of the schemes, each with its own assets and liabilities and therefore its own investment, funding, and contribution strategy. The remainder is in defined contribution (DC) arrangements.

Setting the investment strategy for DB arrangements

Understanding the nature of our clients

Understanding the nature of our clients

The sponsoring employers span a wide range of UK rail-related industries:

- Train operating companies

- Infrastructure such as signalling and consultancies

- Freight operating companies

- Maintenance, builders

- IT and support

- Catering and cleaning

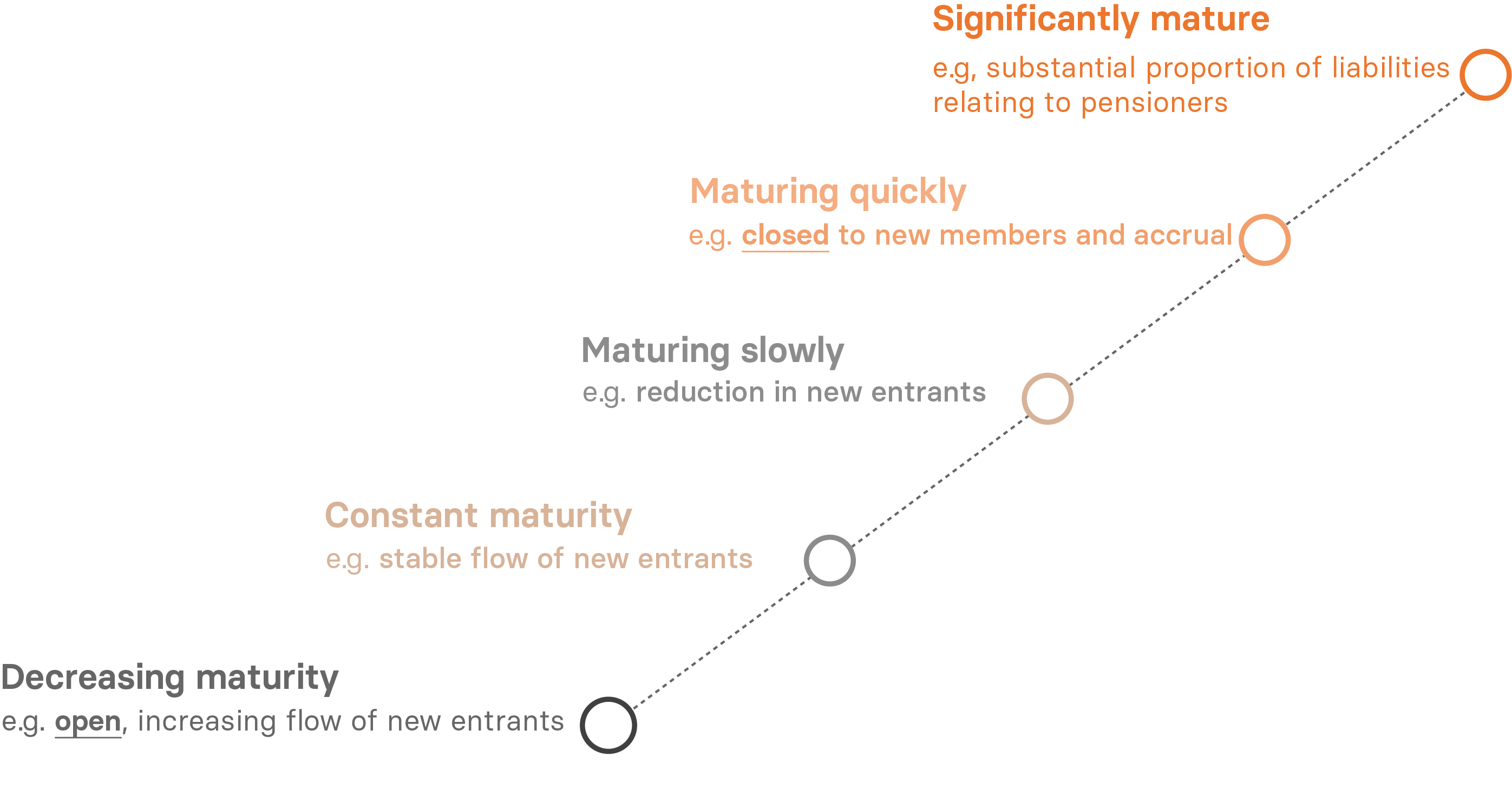

While the sponsoring employers share a common industry, their underlying scheme characteristics vary significantly. This leads to significantly different liability profiles and a diverse range of requirements. Unlike many DB schemes in the UK, many of our client's schemes remain open to new members.

Railpen aims to deliver sufficient long-term returns from the assets to meet each client's liabilities in full over a range of environments.

We deliver tailored, section-specific advice, while harnessing the resources of being part of one of the largest pension arrangements in the UK.

Integrated approach

Integrated approach

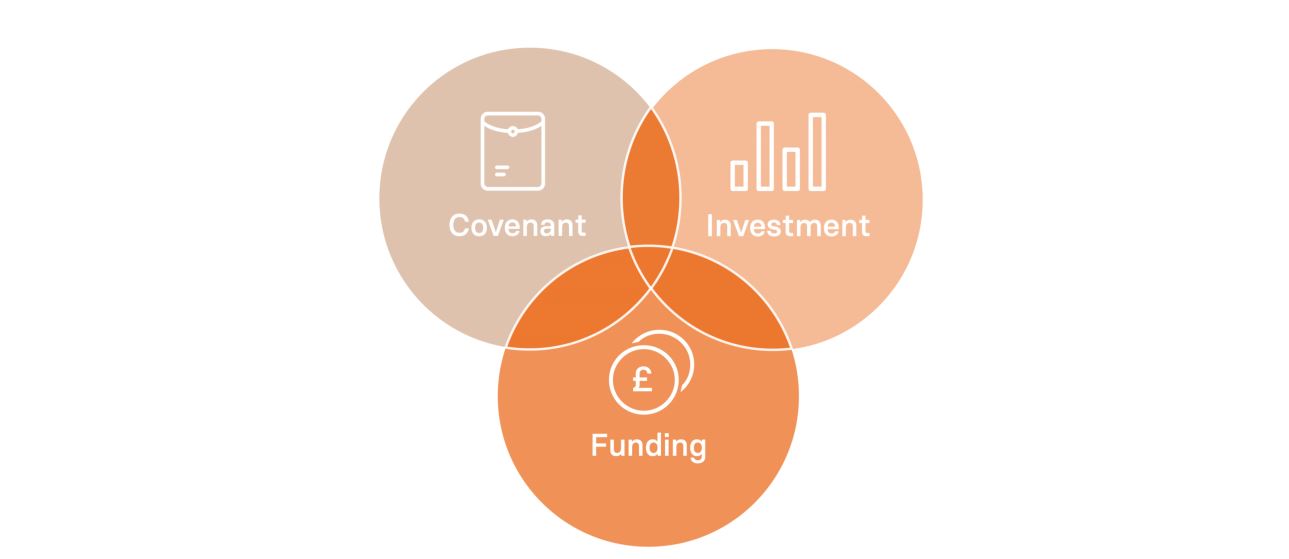

We think of investment strategy in the context of funding level, liability profile, and covenant in an integrated approach to assess, monitor, and manage the risks that could affect an employer's ability to meet their benefit obligations.

The investment strategy and the value placed on the liabilities are inter-linked. The discount rate is influenced by the underlying expected asset return, which in turn is impacted by the liability profile.

Journey planning

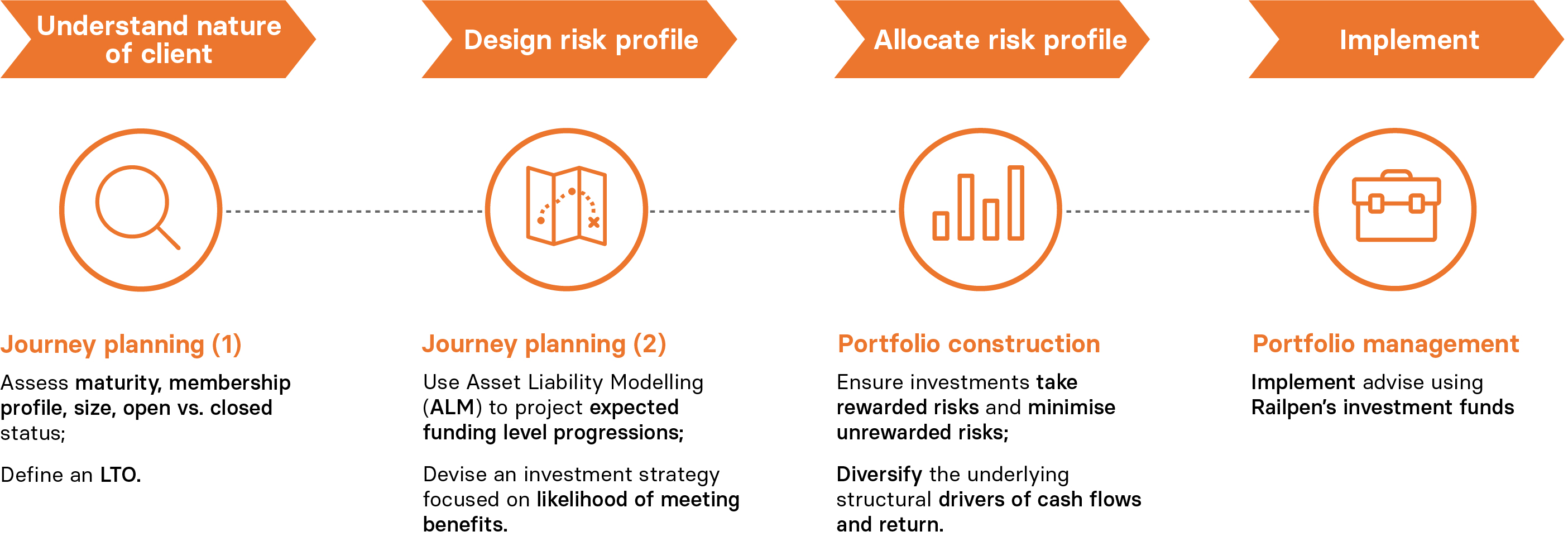

We formulate a journey plan for each client and devise an investment strategy that, taking appropriate levels of risk, aims to achieve the client's long-term objectives.

We design journey plans that balance security of benefits, affordability, and risk appetite:

1) Aim to meet all future benefit cashflows.

2) Ensure contributions are affordable for both members and employers.

3) Mitigate adverse outcomes.

Asset-liability risks

| Investment Belief |

| Managing asset-liability risk is integral to a scheme’s long term success. |

A certain amount of risk is necessary to generate returns, but we focus on ensuring our investments take rewarded risks while minimising unrewarded risks, which may lead to adverse outcomes.

Our multi-faceted risk measures are calibrated to each section's needs and consider both asset and liability risks.

We use Asset Liability Modelling (ALM) to inform our advice. ALM is focused on projecting a central asset-liability scenario and a range of possible alternative outcomes. This is incredibly helpful for Trustees and employers in understanding the likely contribution requirements in the central scenario and the potential to change over time.

Portfolio construction

| Investment Belief |

| Diversification of the overall investment portfolio, across different structural drivers of return, improves the resilience of a scheme's assets in an uncertain world. |

Our portfolio construction process focuses on making a client's assets resilient to a wide range of highly uncertain market or macro environments. We find that identifying the underlying structural drivers of return over the long term is a more effective way to diversify a strategy than relying on short-term risk relationships.

These drivers include local growth and inflation dynamics, differing capital market cycles, consumer/producer cycles, the regulatory and political environment and thematic opportunity sets.

| Investment Belief |

| Long-term focused investment decision making has many advantages that should be carefully exploited. |

It is essential that the portfolio construction process aligns with the client's time horizon. While the schemes in aggregate have long investment horizons, many of our clients are near their end-game. We try to exploit the advantages of long-term focused investment decision making for all clients, while being mindful of inappropriately allocating long-term investments to clients with a relatively short investment horizon. Appropriate sizing of illiquid exposures, given horizons and objectives, is key to the portfolio construction approach.

DC arrangements

In addition to DB, we manage the assets of the Trustee's DC arrangements.

Members are offered a number of self-select funds (with various risk-return characteristics) and lifestyle strategies (including a default option). The funds are designed to cover a range of member preferences, with the lifestyle strategy choices that gradually transition investments from higher-risk funds into funds aiming to reduce the risk of significant drawdown as retirement approaches.

Our scale is a key advantage in our DC offering, allowing access to similar investments as our DB pooled funds where this is appropriate. This allows exposure to more illiquid asset classes and well-diversified, multi-asset investment strategies.

@railpen

@railpen

/railpen

/railpen